Depression in Living Color

Sep 01, 2010

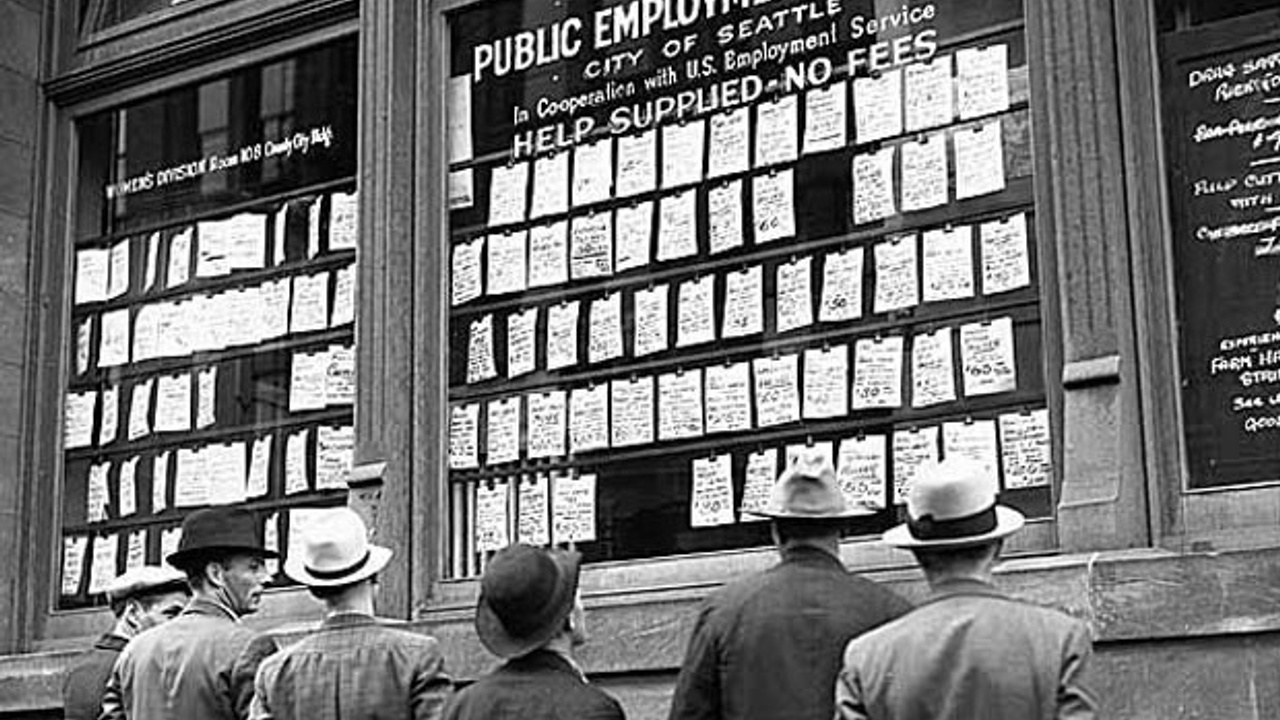

Have you ever noticed when we see pictures or film regarding “The Great Depression”, they are in black and white. I think the black and white images provide an even more drastic impression for the unfortunate financial times of our country at that time.The parallels of that time and today are surprising. I have considered writing this blog for the last two years, finally, I think its time has come.

Two years ago (2008) our country was, what economists said, at the verge of financial brink. The answer? A very large injection of capital into the market. A stimulus of dramatic proportion. Seven hundred and Eighty Seven billion dollars to be exact. At the time, I thought, wow, that is an awful lot of money to inject into an economy with a gross domestic product of 14 trillion. I wondered why so much stimulus was needed for the problem? I also wondered were the United States would get such an amount of money?

Okay, let's answer the first question. Why was so much stimulus needed? A popular form of economics is called the Keynesian theory, based on the ideas of John Maynard Keynes. In a depression or a severe recession, Keynesian theory says that a government needs to do anything possible to “stimulate” the economy. Think of it like CPR for a person who has drowned or had a heart attack. Our government has and currently does believe in this theory of economics.

One of the main issues of the depression of the 1930’s was a lack of liquidity for the markets. The feeling by our government during the 2008 crisis, was the need to prime the pump or jump start the economy by injecting a massive amount of money through stimulus. (Keynesian Economics) That stimulus would be used for projects that would put people back to work, thus having those employed people spend their paychecks as consumers. Fingers crossed, problem would be solved.

Well, our government felt that the $878 billion was not quite enough, and acted upon several other stimulus measures, such as the cash for clunkers deal and the first-time home buyer rebate. This among other things has brought the total stimulus to nearly one trillion dollars. A lot of money…

Now, lets answer the second question. Where would the United States get such a large amount of money to pay for the stimulus? The United States sells treasury bills and bonds to raise cash. In other words, we sell a security, backed by our federal government, mostly to other countries (China and Japan) The security pays a certain interest rate and has a maturity date (1 year, 3 year, 10 year). Once the treasury has the commitment for the bills/bonds, then we can start printing the money to put towards the stimulus. The United States has been doing this for years.

So what’s the problem? Well, we have to pay the interest rate to the buyers of the debt monthly. In addition, when the maturity dates are up, we have to pay the principle amount of the debt back. Think of it like a balloon loan that is due. You still might say, John, I still don’t see what the problem is?

Well, lets think back to basic accounting and look at the financial statement of our country. There are two sides to a financial statement, one side is the cash flow side. The other side is the balance sheet side. Lets look at the cash flow side.

If we look at the cash flow side of our financial statement, you will see that we are running our country at a deficit. Meaning, each year, we spend more than we bring in. This year, 2010, we will spend approximately 1.4 trillion dollars more that we bring in. Where do we get the 1.4 trillion dollars? You guessed it, we use the same process that we discussed earlier, we borrow it. That deficit of 1.4 trillion dollars flows onto the second portion of our financial statement, the balance sheet.

The balance sheet shows typically the assets and liabilities. The assets are enormous when you consider the value of what the country owns, but overshadowed by our massive debt. The problem lies in the liabilities. We have short term debt approaching 14 trillion dollars. We have long term debt and unfunded liabilities (social security, medicare, etc.) approaching 111 trillion dollars. Because of this we having fewer countries buying our debt. The ones that are buying our debt are demanding a higher return. Because we will be borrowing at a higher interest rate, we pay more. Adding yet again to our cash flow problem. Our debts gravity is causing a downward spiral that seems hard to escape. This is what our economy is dealing with now as its major challenge. It is the silent thief stealing our freedoms and future.

Our everyday things like employment, lending, housing, stocks, etc. are now starting to be changed and viewed in a very different way. Why? Well, its because of what’s coming next and not many people are talking about it. This week, the Federal Reserve came out and said that they are ready to take additional action to address the failing economy. They said that they would participate in something called “Quantitative Easing”.

Quantitative easing is when the government increases the money supply. It actually puts more money in supply by lending it to financial institutions. The interest rate it charges to banks and other institutions is close to zero. In other words, it lends money at a zero interest rate to banks so that they can lend out to the public. It creates the money ex nihilo (“out of nothing”). It prints the money, with no one buying it as debt. The government also purchases mortgage backed securities, corporate bonds, etc. to put the cash into the market place. When I heard this statement from the Federal Reserve, last week, I knew I had to write this blog.

I waited on writing this particular blog because I wanted to see what the 1 trillion dollar stimulus would do for our economy. What did it do? It did very little, but get us into more debt. Now that I am starting to see the government’s next moves I wanted to let you know what my concerns are.

In my opinion, I think two things are going to happen. First, we have already started a process of deflation. Where prices are starting to go down. (current pricing of housing, cars, electronics, etc..) Goods and services are now starting to exceed demand. Demand has been suppressed because of high unemployment and lack of lending. This will be magnified as we start to pay higher taxes and interest rates starting in 2011. In the short term, that is a good thing. You will pay less for items than you did say a year ago. But its whats coming after that, that startles me.

Think of it like the tide that receded just before the 2004 Indonesian tsunami. People were curious why the water had receded so much that they had to go out and see for themselves. When prices go down and the market gets flooded with money from savings, the stimulus, and quantitative easing, it will be too late to get out of the way to safe ground. (quantitative easing has taken place) Then from nowhere, there is a giant 100ft. tidal wave coming at you. That tidal wave? inflation… Our market will be flooded with too many dollars chasing too few goods and services.

Normally, with our current economic situation, I would say a little inflation is good for our economy and real estate. As inflation goes up, the prices for things like rent and houses will go up. In a somewhat normal economy, that is a good thing. However, the type of inflation we are headed to is hyperinflation. The cost of goods and services goes up because it will take more dollars to buy things because our dollar will be worth less and less. Hyperinflation is different that normal inflation because it happens much quicker. I feel that it will also happen because of the fact that we do not manufacture things here. Our money goes to other parts of the world, because we import as a nation of consumers. Our money that gets created “out of nothing” will also have a negative impact on the rest of the world. A lower valued dollar will not help their economies either, as this will turn into a global problem. In a sense, it is just like the supply and demand with real estate or anything for that matter. Our economy gets affected dramatically when their is a larger supply of money chasing a fewer supply of goods and services, when the demand is up. With quantitative easing comes the beginning of our dollar crash as a currency.

The deflation positioning is starting to take place now. I feel as the inflationary positioning will take place more rapidly during 2012. Which will lead to a depression in “living color”. Does that mean the world is going to end? No, quite the contrary, I believe, longterm, it is going to lead to the greatest prosperity in history.

So how am I preparing? You will have to read my next blog! Believe me, I think you will be shocked…

"Remember, wealth has nothing to do with money, success has everything to do with failure and life is as simple as you want to make it!" -John Dessauer

Like our blogs? Stay connected to the new blogs that come out and other business and real estate news !

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared or sold (who would do that anyways...)!

We hate SPAM. We will never sell your information, for any reason.